The mica paper manufacturing business presents exceptional growth opportunities, with the global market expanding from USD 662.98 million in 2025 to USD 985.34 million by 2030 at an impressive 8.27% CAGR. With strong demand from electronics, automotive, and renewable energy sectors, entrepreneurs can expect profit margins of 20-30% and achieve break-even at just 39% capacity utilization.

1. Market Overview & Growth Prospects

The mica paper manufacturing business is experiencing unprecedented growth, driven by expanding applications in electrical insulation and high-temperature resistant materials. The global mica paper market grew from USD 611.46 million in 2024 to USD 662.98 million in 2025, with projections reaching USD 985.34 million by 2030.

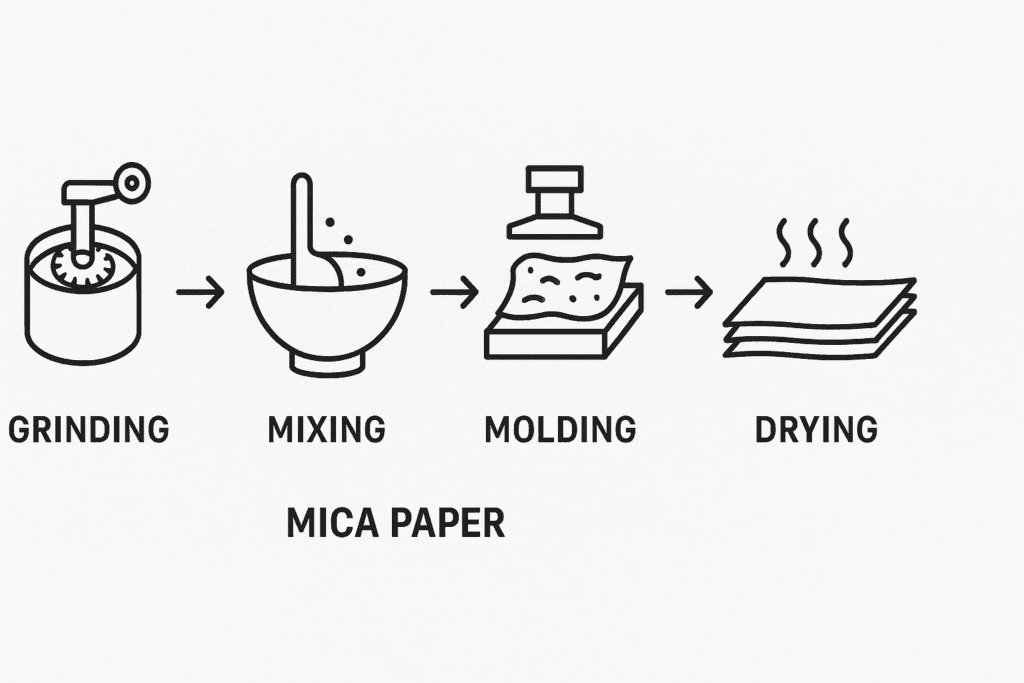

Market Dynamics & Segmentation

| Market Segment | 2024 Value | 2030 Projection | Growth Rate |

|---|---|---|---|

| Global Mica Paper | USD 611.46M | USD 985.34M | 8.27% CAGR |

| Synthetic Mica Paper | USD 200M | USD 350M | 6.5% CAGR |

| Asia-Pacific Region | Dominant | Leading Growth | 5-7% CAGR |

Key Growth Drivers:

- Electronics Industry: Increasing demand for electrical insulation in motors, transformers, and cables

- Electric Vehicle Revolution: Rising EV adoption driving mica paper demand for battery insulation

- Renewable Energy: Solar and wind power infrastructure requiring high-temperature resistant materials

- Aerospace Applications: Growing use in radar systems, laser devices, and aerospace components

2. Raw Materials: Specifications & Cost Analysis

Primary Raw Materials (Annual Requirements for 1000 kg/day capacity)

| Raw Material | Specification | Cost per kg (₹) | Annual Quantity | Annual Cost (₹ Lakhs) |

|---|---|---|---|---|

| Mica (Muscovite/Phlogopite) | High-grade, >90% purity | 120-180 | 300 tonnes | 360-540 |

| Silicone Resin (Heat-resistant) | Food/industrial grade | 250-350 | 20 tonnes | 50-70 |

| Water (Distilled) | Industrial grade | 2-3/1000L | 50,000L/month | 12-18 |

| Kaolinite Clay | Colloid forming agent | 80-120 | 15 tonnes | 12-18 |

| Sepiolite Clay | Binding agent | 100-150 | 10 tonnes | 10-15 |

Procurement Strategy

Inventory Management: Maintain 30-day stock to avoid production disruptions

Mica Sourcing: Direct procurement from mines in Jharkhand, Bihar, and Rajasthan

Quality Control: Implement strict grading systems for mica purity and consistency

Supplier Relationships: Build long-term contracts with reliable suppliers

3. Machinery & Equipment Investment

Core Processing Equipment

| Equipment | Capacity/Specifications | Unit Cost (₹ Lakhs) |

|---|---|---|

| Hammer Mill/Jaw Crusher | 1-2 tonnes/hour | 5.00 |

| Industrial Mixing Units | 500 kg batch capacity | 1.00 |

| Industrial Oven | Temperature: 200-300°C | 0.50 |

| Mica Paper Dryer Machine | Continuous belt dryer | 2.00 |

| Calendaring Machine | Roll width: 1000-1500mm | 1.50 |

| C-type Hydraulic Press | 100-200 ton capacity | 3.00 |

| Cutting Unit | Automatic width control | 1.00 |

| Distilled Water Plant | 1000L/hour capacity | 1.00 |

Total Machinery Investment: ₹15.00 lakhs

Financing Options

- MSME Loans: 9-12% interest rates with government backing

- PMEGP Scheme: Up to 25% capital subsidy for eligible entrepreneurs

- Equipment Leasing: Reduce upfront investment by 60-70%

- State Industrial Schemes: Additional subsidies in manufacturing-focused states

4. Manpower Requirements & Structure

Workforce Distribution

| Designation | Count | Monthly Salary (₹) | Annual Cost (₹ Lakhs) |

|---|---|---|---|

| Machine Operators | 2 | 18,000 | 4.32 |

| Skilled/Unskilled Workers | 3 | 15,000 | 5.40 |

| Helpers | 4 | 12,000 | 5.76 |

| Manager cum Accountant | 1 | 25,000 | 3.00 |

| Sales Personnel | 2 | 20,000 | 4.80 |

Total Annual Manpower Cost: ₹23.28 lakhs (including benefits)

Skill Development Requirements

- Technical Training: Machine operation and quality control protocols

- Safety Training: High-temperature equipment handling and chemical safety

- Quality Assurance: Testing procedures for electrical and thermal properties

5. Plant Setup & Infrastructure

Space & Layout Requirements

- Total Area: 2,000-2,500 sq ft industrial space

- Production Area: 60% – machinery and processing

- Raw Material Storage: 20% – climate-controlled storage

- Finished Goods: 15% – quality testing and packaging

- Office & Utilities: 5% – administrative and power infrastructure

Infrastructure Costs

| Component | Specifications | Cost (₹ Lakhs) |

|---|---|---|

| Land (Purchase/Lease) | Industrial plot 2,500 sq ft | 5.00-15.00 |

| Building Construction | RCC structure with utilities | 8.00-12.00 |

| Electrical Installation | 45 HP power load | 2.00-3.00 |

| Water Treatment System | Distillation and recycling | 1.50-2.50 |

| Office & Furniture | Administrative setup | 0.60 |

Total Infrastructure: ₹17.10-33.10 lakhs

6. Operations & Utilities

Daily Operational Requirements

| Utility | Consumption | Rate | Daily Cost (₹) | Annual Cost (₹ Lakhs) |

|---|---|---|---|---|

| Electricity (45 HP) | 300 units | ₹7/unit | 2,100 | 6.30 |

| Water | 2,000 liters | ₹3/1000L | 6 | 0.18 |

| Fuel (Boiler) | 50 kg coal | ₹25/kg | 1,250 | 3.75 |

| Maintenance | Daily spares | – | 150 | 0.45 |

| Labor (daily wages) | – | – | 1,950 | 5.85 |

Total Monthly OPEX: ₹1.37 lakhs

Total Annual OPEX: ₹16.53 lakhs

Production Capacity

- Design Capacity: 1,000 kg/day (300 tonnes/year)

- Year 1 Utilization: 50% (150 tonnes)

- Optimal Utilization: 80-85% by Year 3

- Quality Standards: Electrical grade mica paper meeting IS standards

7. Logistics & Transportation

Supply Chain Management

- Inbound Materials: Truck transportation from mica mining regions

- Freight Costs: ₹3-5 per kg for raw materials within 500 km

- Quality Inspection: Pre-delivery testing at supplier facilities

- Inventory Buffer: 30-day safety stock for critical materials

Distribution Channels

- Direct Sales: To electrical equipment manufacturers

- Distributor Network: Regional distributors for broader reach

- Export Opportunities: Southeast Asia and Middle East markets

- Online Platforms: B2B marketplaces for smaller orders

8. Financial Analysis & Projections

Investment Structure

| Component | Amount (₹ Lakhs) | Funding Source |

|---|---|---|

| Plant & Machinery | 15.00 | Term Loan (70%) + Equity (30%) |

| Furniture & Fixtures | 0.60 | Own Contribution |

| Working Capital | 6.11 | CC Limit |

| Total Project Cost | 21.71 | Mixed Financing |

Revenue & Profitability Analysis (5-Year Projection)

| Year | Capacity | Production (kg) | Sales (₹ Lakhs) | Net Profit (₹ Lakhs) | ROI (%) |

|---|---|---|---|---|---|

| 1 | 50% | 150,000 | 94.25 | 4.81 | 22.2% |

| 2 | 60% | 180,000 | 110.13 | 6.01 | 27.7% |

| 3 | 70% | 210,000 | 123.78 | 7.16 | 33.0% |

| 4 | 80% | 240,000 | 138.15 | 8.61 | 39.6% |

| 5 | 85% | 255,000 | 153.27 | 10.03 | 46.2% |

Key Financial Metrics

- Break-even Point: 39% capacity utilization

- Payback Period: 5 years

- DSCR: 2.69 (excellent debt servicing capability)

- Gross Margin: 16.7-19.5%

- Net Margin: 5.1-7.7%

9. Regulatory Framework & Licensing

Required Approvals

- Factory License: Under the Factories Act, 1948

- Pollution Control Board: Environmental clearance for industrial operations

- GST Registration: For business operations and tax compliance

- MSME Registration: For government scheme benefits

- ISI Certification: Quality standards for electrical applications

- Export License: If planning international sales

Uttarakhand State Incentives

| Incentive Type | Benefit | Duration |

|---|---|---|

| Capital Subsidy | 25% of fixed investment | One-time |

| Interest Subsidy | 5% on term loans | 7 years |

| Power Subsidy | ₹2/unit discount | 5 years |

| Stamp Duty | 100% exemption | – |

| VAT Exemption | Complete waiver | 10 years |

10. Market Strategy & Applications

Target Industries

| Application Sector | Product Usage | Market Potential |

|---|---|---|

| Electrical Equipment | Motor insulation, transformers | 40% market share |

| Electronics | Circuit boards, capacitors | 25% market share |

| Automotive | EV battery insulation | 20% market share |

| Aerospace | High-temp applications | 10% market share |

| Construction | Fire-resistant materials | 5% market share |

Pricing Strategy

- Bulk Orders (>1000 kg): ₹600-800/kg

- Standard Orders (100-1000 kg): ₹700-900/kg

- Small Orders (<100 kg): ₹800-1000/kg

- Premium Grade: 20-30% price premium

Frequently Asked Questions (FAQs)

1. What is the minimum investment required for a mica paper manufacturing business?

The minimum investment is approximately ₹21.71 lakhs, including machinery, infrastructure, and working capital requirements.

2. What are the profit margins in mica paper manufacturing?

Entrepreneurs can expect gross profit margins of 16.7-19.5% and net profit margins of 5.1-7.7%, with potential for 20-30% margins with efficient operations.

3. What is the production capacity for a small-scale unit?

A standard setup can produce 1,000 kg per day or 300 tonnes annually at full capacity, with first-year operations typically at 50% utilization.

4. Which industries are the primary customers for mica paper?

Major customers include electrical equipment manufacturers (40%), electronics companies (25%), automotive sector (20%), and aerospace industry (10%).

5. What are the key raw materials required?

Primary materials include high-grade mica (muscovite/phlogopite), silicone resin, distilled water, and clay-based binding agents.

6. What government incentives are available?

Entrepreneurs can access PMEGP subsidies (up to 25%), MSME benefits, and state-specific incentives like capital subsidies and power rebates.

7. What is the break-even point for this business?

The business reaches break-even at 39% capacity utilization, making it a relatively low-risk investment with quick returns.

8. Are there export opportunities for mica paper?

Yes, significant export potential exists in Southeast Asia, Middle East, and European markets, with growing demand for electrical insulation materials.

9. What skills are required for workers?

The business requires 2 skilled machine operators, 3-4 semi-skilled workers, and support staff, with total employment generation for 12 persons.

10. How long does it take to set up the plant?

The complete project implementation period is 5-6 months, including licensing, construction, machinery installation, and trial production.

This comprehensive guide positions entrepreneurs to capitalize on the rapidly growing mica paper market, offering a clear pathway to establish a profitable manufacturing venture with strong market fundamentals and government support.

- https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/attachments/82100930/64e5d9bc-43e8-4413-bca8-aeafe534b1e1/micapaper.pdf

- https://www.researchandmarkets.com/reports/6017458/mica-paper-market-type-natural-synthetic

- https://www.openpr.com/news/4123299/global-mica-market-set-to-reach-usd-870-7-million-by-2035-driven

- https://upmsme.com/project-report/mica-paper-making-unit

- https://www.marketreportanalytics.com/reports/phlogopite-mica-paper-180125

- https://www.cognitivemarketresearch.com/mica-paper-market-report

- https://lebasic.com/v2/content/uploads/2023/04/RMI_20230314_Mica-income-wage-and-cost-analysis_RMI-Overview-Full-Reports.pdf

- https://www.linkedin.com/pulse/synthetic-mica-paper-market-turnaround-2025-digital-transition-fvbff/

- https://www.linkedin.com/pulse/mica-paper-market-report-2026-regional-analysis-projected-growth-6h5wc/

- https://www.entrepreneurindia.co/blogs/wet-ground-mica/

- https://www.businessresearchinsights.com/market-reports/mica-paper-market-100022