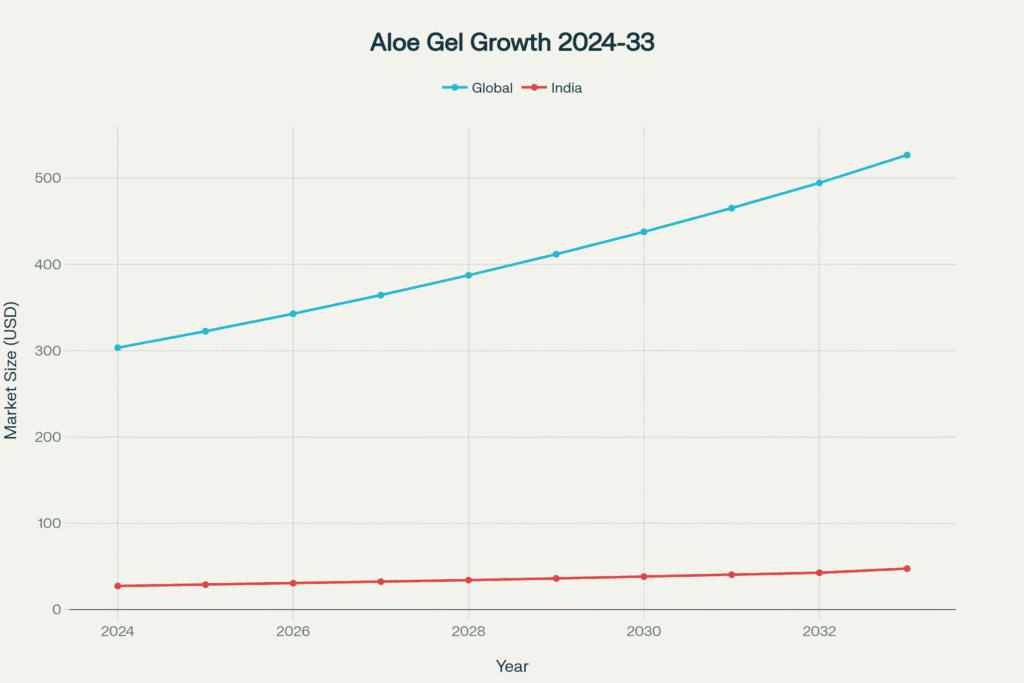

The aloe vera gel manufacturing industry represents one of the most profitable and sustainable opportunities in today’s natural products market. With the global aloe vera gel market projected to reach USD 526.7 million by 2033 at a 6.3% CAGR, and India’s domestic market growing at 5.7% annually, entrepreneurs have unprecedented opportunities to capitalize on this booming sector.

1. Raw Materials

Primary Raw Material Requirements for annual production capacity of 50,000 liters:

| Material | Annual Requirement | Unit Cost (₹) | Total Cost (₹) | Sourcing Strategy |

|---|---|---|---|---|

| Fresh Aloe Vera Leaves | 150,000 kg | 15-18 | 22,50,000 | Contract farming/Own cultivation |

| Calcium Hypochlorite | 500 kg | 80 | 40,000 | Chemical suppliers |

| Carbopol (Thickening Agent) | 200 kg | 350 | 70,000 | Specialty chemical distributors |

| Aristoflex (Stabilizer) | 150 kg | 450 | 67,500 | Import/authorized dealers |

| Preservatives & Additives | Lump sum | – | 1,50,000 | Cosmetic ingredient suppliers |

| Packaging Materials | 50,000 units | 8 | 4,00,000 | Local/regional suppliers |

| Total Raw Material Cost | – | – | 28,77,500 | – |

Procurement Strategies:

- Contract Farming: Partner with local farmers for a guaranteed supply at ₹15-18/kg

- Own Cultivation: 1 acre yields 60,000 plants producing 10 tons annually

- Bulk Purchasing: Negotiate 30-45 day credit terms with chemical suppliers

- Quality Assurance: Source only mature leaves (8-12 months old) for optimal gel content

2. Machinery & Equipment

Complete Plant & Machinery Setup:

Comprehensive cost breakdown for aloe vera gel manufacturing plant setup

Essential Equipment Specifications:

Financing Options:

- Purchase: Bank term loans at 11-12% interest

- Lease: Equipment leasing at 8-10% annual rates

- Government Schemes: MUDRA loans up to ₹10 lakhs

- Subsidies: 25% subsidy under MSME schemes

3. Manpower Requirements

Skilled Workforce Structure for optimal operations:

| Role | Headcount | Monthly Salary (₹) | Annual Benefits (12%) | Hiring Channel |

|---|---|---|---|---|

| Plant Manager | 1 | 35,000 | 50,400 | Industry recruitment |

| Quality Control Officer | 1 | 28,000 | 40,320 | Technical institutes |

| Production Supervisors | 2 | 22,000 each | 31,680 each | Local technical colleges |

| Machine Operators | 4 | 18,000 each | 25,920 each | Skill development centers |

| Processing Workers | 6 | 14,000 each | 20,160 each | Local employment exchanges |

| Packaging Staff | 4 | 12,000 each | 17,280 each | Direct recruitment |

| Total Monthly Cost | 18 | 3,26,000 | 46,800 | – |

Training & Development:

- Technical training at specialized institutes

- FSSAI certification for food-grade processing

- Safety protocols and equipment handling

- Quality control and testing procedures

4. Plant Setup & Infrastructure

Recommended Facility Requirements:

Land & Building: 1,200-1,500 sq ft industrial space

- Location: Industrial zones with MSME benefits

- Layout: Raw material storage (300 sq ft), processing area (600 sq ft), finished goods storage (200 sq ft), office space (100 sq ft)

- Construction Cost: ₹2,00,000 for civil works and setup

Infrastructure Investment:

| Component | Specification | Cost (₹) |

|---|---|---|

| Building/Shed Rental | ₹25/sq ft/month | 3,00,000/year |

| Electrical Installation | 100 KVA capacity | 2,50,000 |

| Water Treatment Plant | 1,000L/day capacity | 1,50,000 |

| Generator Backup | 50 KVA | 2,00,000 |

| Total Setup Cost | – | 9,00,000 |

5. Operations & Utilities

Monthly Operational Expenses:

| Expense Category | Load/Usage | Rate | Monthly Cost (₹) |

|---|---|---|---|

| Electricity | 45 HP load @ 8 hrs | ₹8/unit | 86,400 |

| Water | 1,000L/day | ₹25/KL | 750 |

| Fuel (Generator) | 200L diesel | ₹85/L | 17,000 |

| Maintenance | 3% of machinery | – | 15,000 |

| Consumables | Testing materials | – | 8,000 |

| Total Monthly OPEX | – | – | 1,27,150 |

Annual Operational Cost: ₹15,25,800

6. Logistics & Transportation

Inbound Raw Materials:

- Fresh Leaves: Direct farm pickup using refrigerated vehicles

- Chemicals: Road transport from Mumbai/Delhi chemical hubs

- Packaging: Regional suppliers with 15-day lead time

- Transportation Cost: 8% of raw material value

Outbound Distribution:

- B2B Sales: Direct delivery to cosmetic manufacturers

- Retail: Third-party logistics at ₹15/kg

- Export: Container shipping to the Middle East/Europe

- Warehousing: 500 sq ft cold storage at ₹8/sq ft/month

7. Financial Analysis

Revenue Projections:

| Product Category | Volume (L/year) | Selling Price (₹/L) | Revenue (₹) |

|---|---|---|---|

| Bulk Industrial | 30,000 | 180 | 54,00,000 |

| Retail Bottles | 15,000 | 400 | 60,00,000 |

| Cosmetic Grade | 5,000 | 600 | 30,00,000 |

| Total Revenue | 50,000 | – | 1,44,00,000 |

Cost Analysis:

- Raw Materials: ₹28,77,500 (20% of revenue)

- Manufacturing: ₹15,25,800 (11% of revenue)

- Manpower: ₹39,12,000 (27% of revenue)

- Other Expenses: ₹14,40,000 (10% of revenue)

- Total Cost: ₹97,55,300

Profitability Metrics:

- Gross Profit: ₹46,44,700 (32% margin)

- Net Profit: ₹35,20,000 (after taxes)

- Break-even: 28% capacity utilization

- Payback Period: 3.5-4 years

- ROI: 35% annually

8. Regulatory & Incentives

Mandatory Registrations & Licenses:

- FSSAI License: For food-grade gel processing

- Drug License: For cosmetic-grade products

- GST Registration: 18% applicable rate

- MSME Registration: For government benefits

- Pollution Control: State board clearance

Government Incentives & Subsidies:

- National Horticulture Mission: 50% infrastructure subsidy

- APEDA Support: Export infrastructure development

- NMPB Schemes: 20% cultivation subsidy for aloe vera

- Mudra Loans: Up to ₹10 lakhs at subsidized rates

- State Incentives: Power rebates and land subsidies

Uttarakhand Specific Benefits:

- Capital Subsidy: 30% of project cost up to ₹50 lakhs

- Power Subsidy: 25% electricity cost reduction for 5 years

- Stamp Duty: 100% exemption on land/building registration

Market Growth Trajectory

The aloe vera gel industry presents a lucrative opportunity with proven market demand and sustainable growth potential. With proper planning, quality focus, and strategic market positioning, entrepreneurs can build a profitable venture that capitalizes on the global shift toward natural, herbal products.

Frequently Asked Questions (FAQ)

The aloe vera gel industry presents a lucrative opportunity with proven market demand and sustainable growth potential. With proper planning, quality focus, and strategic market positioning, entrepreneurs can build a profitable venture that capitalizes on the global shift toward natural, herbal products.

Frequently Asked Questions (FAQ)

Q1: What is the minimum investment required to start an aloe vera gel manufacturing business?

A: The total investment ranges from ₹24-26 lakhs, including ₹18 lakhs for plant & machinery, ₹2-3 lakhs for infrastructure, and ₹3-5 lakhs for working capital.

Q2: What is the expected profit margin in aloe vera gel manufacturing?

A: The business offers attractive profit margins of 30-35%. With production costs around ₹150-200 per liter and selling prices of ₹180-600 per liter depending on grade, the gross profit margin is substantial.

Q3: How much raw material is required annually?

A: For 50,000 liters of annual production, you need approximately 150,000 kg of fresh aloe vera leaves, costing ₹22-27 lakhs annually at current market rates of ₹15-18 per kg.

Q4: What machinery is essential for aloe vera gel production?

A: Key equipment includes washing units, gel extraction machines, homogenizers, filtration systems, and filling machines. A complete processing plant costs ₹15-18 lakhs.

Q5: What are the main customers for aloe vera gel?

A: Primary customers include cosmetic manufacturers, pharmaceutical companies, personal care brands, herbal product companies, and direct retail consumers.

Q6: How long does it take to break even?

A: With proper execution, break-even can be achieved at 28% capacity utilization within 6-8 months. Full payback period is 3.5-4 years.

Q7: What government subsidies are available?

A: Multiple schemes offer support, including National Horticulture Mission (50% subsidy), NMPB schemes (20% for cultivation), MUDRA loans, and state-specific incentives like capital subsidies up to 30%.

Q8: What is the shelf life and storage requirement?

A: Processed aloe vera gel has an 18-24-month shelf life when properly preserved and stored in cool, dry conditions. Cold storage facilities may be required for bulk quantities.

Q9: Can I start with contract manufacturing?

A: Yes, contract manufacturing is a viable option to minimize initial investment. Many established companies offer private labeling opportunities with lower capital requirements.

Q10: What quality certifications are needed?

A: Essential certifications include FSSAI license for food-grade products, cosmetic manufacturing license, GMP certification, and organic certification if targeting premium markets.

Q11: How much manpower is required?

A: A standard unit requires 13-18 people, including supervisors, operators, processing workers, quality control staff, and support personnel, with monthly salary costs of ₹3-4 lakhs.

Q12: What are the export opportunities?

A: Strong export potential exists, particularly to the Middle East, the USA, and European markets. India exported aloe vera products worth over $50 million in 2024.

Q13: How do I ensure a consistent raw material supply?

A: Establish contract farming arrangements with local growers, consider backward integration with own cultivation (1 acre yields 10 tons annually), and maintain relationships with multiple suppliers.

Q14: What are the main challenges in this business?

A: Key challenges include raw material quality consistency, seasonal availability, maintaining the cold chain, regulatory compliance, and competition from established players.

Q15: Is location important for the plant setup?

A: Yes, proximity to aloe vera cultivation areas, good transportation connectivity, reliable power supply, and industrial zone benefits are crucial factors for optimal operations.

References:

https://www.emergenresearch.com/industry-report/aloe-vera-gel-market

https://www.imarcgroup.com/aloe-vera-gel-market

https://www.imarcgroup.com/india-aloe-vera-gel-market

https://www.agrifarming.in/aloe-vera-farming-project-report-cost-and-profit

https://www.advancingnortheast.in/wp-content/uploads/2021/08/Grithkumari-PP-converted.pdf

https://www.tradeindia.com/question-answer/how-much-aloe-vera-can-you-plant-on-an-acre/

https://www.npcsblog.com/aloe-vera-gel-and-powder-manufacturing-business/

https://apkatax.in/blog/how-to-start-aloe-vera-gel-manufacturing-business/

https://www.kviconline.gov.in/pmegp/pmegpweb/docs/commonprojectprofile/AloveraGelmfg.pdf

https://www.kviconline.gov.in/pmegp/pmegpweb/docs/commonprojectprofile/AloeveraJuice.pdf

https://odihort.nic.in/sites/default/files/Operational-Guidelines.pdf

https://icar.org.in/en/node/3918

https://www.raman-industries.com/aloe-veragel-extraction-machinery.html

https://www.alliedmarketresearch.com/aloe-vera-gel-market

https://www.entrepreneurindia.co/blogs/aloe-vera/

https://www.imarcgroup.com/aloe-vera-processing-plant-project-report

https://www.imarcgroup.com/aloe-vera-gel-manufacturing-plant-project-report

https://www.futuremarketinsights.com/reports/aloe-vera-gel-market

https://www.tradeindia.com/products/automatic-aloe-vera-processing-plant-c8409020.html

https://www.tradeindia.com/manufacturers/aloe-vera-processing-plant.html

https://www.linkedin.com/pulse/aloe-vera-gel-powder-manufacturing-profitable-ux8yc

https://www.zionmarketresearch.com/report/aloe-vera-gel-market

https://www.aajjo.com/product/aloe-vera-processing-plant-in-palghar-united-technologie

https://www.youtube.com/watch?v=G-iXTamSC7Q

https://www.tradeindia.com/delhi/aloe-vera-processing-machine-city-228067.html

https://www.tradeindia.com/manufacturers/aloe-vera-processing-machine.html

https://www.imarcgroup.com/aloe-vera-juice-processing-plant-project-report

https://www.24chemicalresearch.com/reports/259415/india-aloe-vera-gel-market

https://www.tradeindia.com/indore/aloe-vera-gel-city-196883.html

https://www.tridge.com/intelligences/aloe-vera-leaf/price

https://mbda.gov.in/success-story-layland-marak-who-pioneered-aloe-vera-processing-garo-hills

https://www.htfmarketintelligence.com/report/global-aloe-vera-gel-market